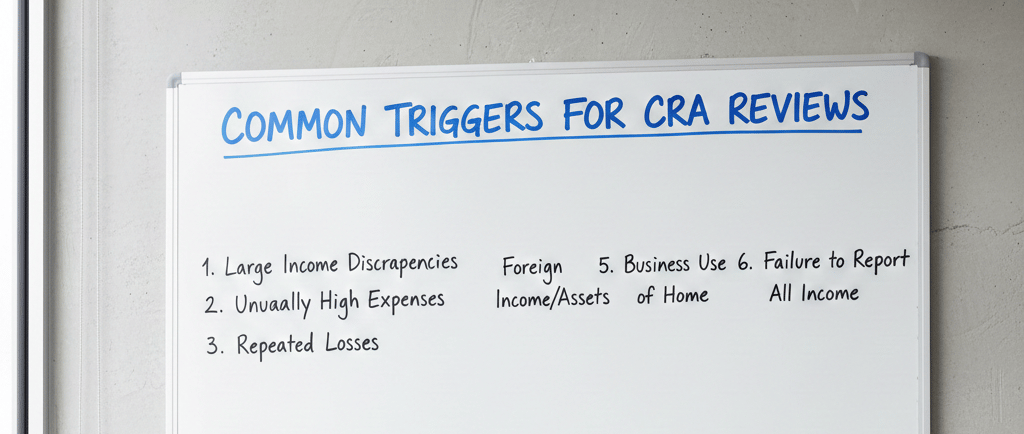

Common Triggers for CRA Reviews

Learn the most common triggers for CRA reviews and how to avoid them. Understand what flags your tax return and steps to stay compliant with the Canada Revenue Agency.

12/2/20252 min read

Common Triggers for CRA Reviews: What Canadians Should Know

When you file your taxes, you expect the process to go smoothly. But sometimes, the Canada Revenue Agency (CRA) decides to take a closer look. A CRA review doesn’t always mean you did something wrong—however, certain situations and filing patterns can increase the chance of being selected.

In this article, we break down the most common triggers for CRA reviews and how you can reduce your risk with proper documentation and accurate reporting.

1. Large or Unusual Changes Compared to Previous Years

The CRA compares your tax return with your past filings. If something stands out, it may prompt a review.

Common examples include:

A sudden spike in income

A large drop in reported income

Significant increases in deductions or credits

New types of claims you’ve never filed before

Consistency matters. If you have legitimate changes, always keep supporting documents.

2. High Claims for Deductions or Credits

The CRA pays special attention to unusually high claims, especially for deductions that are commonly misused.

Areas often reviewed:

Employment expenses

Medical expenses

Tuition credits

Moving expenses

Business-related deductions

If your claims fall far above average, expect the CRA to ask for receipts or proof.

3. Self-Employment Income and Business Expenses

Individuals who run a business or do freelance work are more likely to be reviewed. The CRA wants to ensure business expenses are legitimate and reasonable.

Red flags include:

High expense-to-income ratio

Claiming personal expenses as business expenses

Cash-based businesses

Missing invoices or unclear bookkeeping

Good recordkeeping is essential if you’re self-employed.

4. Home Office and Vehicle Expense Claims

Since the pandemic, home office claims have increased—and so has CRA scrutiny.

The CRA often reviews:

Home office size vs. home size

Reasonableness of utilities and rent claims

Vehicle logbooks for mileage claims

Whether you qualify based on work-from-home requirements

Even small errors can trigger a review.

5. Discrepancies Between Employer/Bank Slips and Your Return

The CRA matches your T4s, T5s, and other tax slips with your return using automated systems.

A review may be triggered if:

You forget to include a slip

Information doesn’t match what your employer or bank submitted

There are errors in reported amounts

Always double-check your tax slips before filing.

6. Random Selection

Not all CRA reviews are triggered by a specific issue. Some are simply random checks done to maintain compliance across Canada. Even if nothing is wrong, you may be selected.

Being prepared with proper documentation helps the process go smoothly.

7. Rental Income Reporting Issues

Rental income is another area where reporting mistakes are common.

CRA may review if:

Rental income seems too low

Expense claims (such as repairs or mortgage interest) are unusually high

Capital cost allowance (CCA) appears excessive

Accurate records and receipts are key to avoiding problems.

8. Repeated Errors or Previous CRA Reviews

If you’ve been reviewed before and the CRA found issues, future returns may face stricter scrutiny.

Examples include:

Filing late

Frequent corrections

Past disallowed deductions

Consistency and accuracy help build trust with the CRA over time.

How to Reduce the Chances of a CRA Review

Here are practical steps to avoid unnecessary scrutiny:

Keep receipts and documentation for at least six years

Report all income accurately

Only claim deductions you qualify for

Use professional tax services if unsure

Avoid rounding numbers—use exact amounts

Review your return before submitting

A clean, organized tax return is your best defense.

Final Thoughts

A CRA review can be stressful, but knowing the common triggers helps you file confidently and avoid mistakes that could delay your refund. If you’re unsure about certain claims or need support during a CRA review, professional guidance can make the process much smoother.

TiKi Tax

© 2025. All rights reserved.